FAQ

Frequently Asked Questions

General Questions

What platform does FundedFX use?

FundedFX uses Match Trader as the only supported trading platform. All evaluations and funded accounts are managed through Match Trader.

Match Trader is a modern platform designed for active traders. It offers:

- Fast and reliable trade execution

- Advanced charting tools with customizable indicators

- A clean and intuitive interface

- Compatibility with both web and mobile devices

Match Trader is accessible through a web browser or by downloading the official mobile app.

Is weekend holding allowed?

No. Weekend holding is strictly not allowed for any account type.

All trades must be closed before the market closes. If you leave a position open over the weekend, it will be considered a rule violation.

This rule exists to protect against weekend market gaps. Prices can change significantly between Friday’s close and Sunday’s open. These gaps can cause major losses and create unnecessary risk for both the trader and the firm. Closing trades before the weekend helps maintain fair and stable trading conditions.

What are the trading commissions and spreads?

FundedFX charges a $2 commission per side, which totals $4 per round trip trade.

- A round trip trade means opening and closing a position.

- If you trade a pair that is not denominated in USD, the commission will be converted to USD automatically.

Spreads are variable, which means they change based on current market conditions.

- Spreads are usually tighter during high-liquidity hours, such as the London and New York sessions.

- They can widen during off-hours, news events, or periods of high volatility.

There are no hidden platform or maintenance fees. All trading costs are clearly stated up front, giving you a transparent trading environment.

Do you support news trading?

Yes, news trading is allowed on both challenge accounts and funded accounts.

However, there are specific rules to follow when trading around news events:

- If you open or close a trade within 2 minutes before or after a scheduled news release, the trade must stay open for at least 2 full minutes to be considered valid.

- This rule helps prevent traders from exploiting extreme short-term volatility without taking on meaningful market exposure.

You are free to trade during high-impact events like NFP, CPI, or interest rate decisions—as long as you follow the minimum duration rule.

There are no restrictions on using news-based strategies as long as your trades comply with the timing requirement above.

Are trade copiers or expert advisors (EAs) allowed?

Yes. FundedFX allows the use of both trade copiers and expert advisors (EAs).

This means you can:

- Use automated strategies (algorithms or bots)

- Copy trades from another account, signal, or provider

Just make sure that the strategy you use still respects all trading rules, including:

- The 5-minute average trade duration requirement

- Daily and overall drawdown limits

- No all-or-nothing or high-risk gambling-style behavior

Using automation is fine—as long as it follows the same risk and trade behavior rules as manual trading.

Do you offer swap-free (Islamic) accounts?

At this time, FundedFX does not offer swap-free (Islamic) accounts.

All accounts incur standard overnight swap charges based on the instruments being traded. If swap-free accounts become available in the future, it will be announced on the website and through official channels.

Is there an inactivity policy?

Yes. FundedFX has a 30-day inactivity policy.

If you do not log into your account or place any trades for 30 consecutive days, your account will be permanently deactivated.

This applies to both challenge accounts and funded accounts.

- Once an account is deactivated due to inactivity, it cannot be reactivated.

- If you wish to continue trading after that, you will need to purchase a new challenge.

To avoid this, simply log in and place at least one trade within any 30-day period to keep your account active.

What happens if I break the rules?

Breaking any of FundedFX’s trading rules may result in one of the following, depending on the violation:

- Challenge account termination (if during evaluation)

- Funded account termination

- Loss of payout eligibility

- Disqualification from scaling or future funding

Common rule violations include:

- Holding trades over the weekend

- Exceeding max daily or overall drawdown

- Using all-or-nothing or high-risk strategies

- Placing trades that do not follow the 5-minute rule

- Violating news event timing rules

Always read the full list of trading rules before you start, so you know exactly what’s allowed.

Can I hold trades overnight?

Yes. Overnight holding is allowed, but weekend holding is not.

You can keep positions open at the end of the day as long as the market remains open. However, all positions must be closed before the market closes on Friday to avoid violations.

Be aware that holding trades overnight can expose you to:

- Swap charges

- Wider spreads during rollover hours

- Increased volatility during low liquidity periods

These risks are part of normal trading conditions and are your responsibility to manage.

Challenge

How does the Classic 1-Step Challenge work?

The 1-Step Challenge is a fast-track evaluation designed for experienced traders who want to get funded without delays. There’s no second phase—just one clear target, a defined risk limit, and a direct path to a funded account.

Here’s how it works:

- Hit an 8% profit target within 30 calendar days

- Stay within a 4% daily and 8% overall drawdown

- Complete at least 7 minimum trading days

Leverage is set up to 1:30, and most trading styles are allowed—including news trading and EAs—so long as you follow the rules.

If you meet all the conditions, you’ll receive a funded simulated account with the same starting balance as your challenge account. The profit split starts at 80/20 and can scale to 90/10 with addons.

There’s no second step, no waiting. Just clear rules, solid risk parameters, and a direct opportunity to prove yourself and scale.

How does the Classic 2-Step Challenge work?

The Classic 2-Step Challenge is the evaluation process you must complete to qualify for a funded account. It’s designed to test your trading consistency, risk management, and profitability—without putting pressure on time limits or forced strategies.

Here’s how it works:

- Phase 1: Hit an 8% profit target within 30 calendar days

- Phase 2: Hit a 5% profit target within 60 calendar days

- You must respect the drawdown limits and complete the required minimum trading days in both phases

If you pass both phases while following all the rules, you’ll be offered a funded account with the same starting balance as your challenge account.

There are no hidden rules or tricks. The challenge is designed to simulate realistic trading conditions and reward skilled, disciplined traders.

How long do I have to complete each phase?

| Challenge type | Phase | Time allowed |

|---|---|---|

| Classic 1-Step | Single phase | 30 calendar days |

| Classic 2-Step | Phase 1 | 30 calendar days |

| Phase 2 | 60 calendar days |

Note: The countdown begins when the phase is activated. Weekends and public holidays count. If the profit target is not met within the period shown, the phase (or the whole challenge, for 1-Step) is considered failed and you would need to restart or purchase a reset.

What are the minimum trading day requirements?

| Challenge type | Phase | Standard trading-day requirement | Minimum with add-ons |

|---|---|---|---|

| Classic 1-Step | Single Phase | 7 days | 4 days |

| Classic 2-Step | Phase 1 | 5 days | 2 days |

| Phase 2 | 7 days | 4 days |

Note: A trading day counts only when you open and close a trade within the same 24-hour cycle measured by our server (the “rollover,” usually 5 pm EST). If a trade stays open past that rollover, the opening day is ignored; the day you close the trade is the one that gets added to your trading-day total. For example, if you open a trade on Monday and close it on Tuesday, only Tuesday counts toward your trading-day total.

What leverage is offered during the challenge?

| Asset | One Step Challenge | Two Steps Challenge | |

| Phase One | Phase One | Phase Two | |

| Forex | 1:30 | 1:50 | 1:80 |

| Indices/Stock | 1:5 | 1:10 | 1:20 |

| Crypto | 1:0.5 | 1:1 | 1:2 |

| Metal/Energy | 1:10 | 1:20 | 1:30 |

Can I retake the challenge if I fail?

Yes. If you fail the challenge, you can purchase a new one and try again.

There is no limit to how many times you can retry. However, each attempt requires a new challenge fee based on the account size you select.

Make sure to review the rules carefully before retaking the challenge to avoid repeating mistakes. Things like max drawdown violations, rule breaches, or risky trade behavior are the most common reasons traders fail.

Are there any restrictions on trading style?

FundedFX gives traders the freedom to use most strategies, but there are a few important restrictions to ensure fair use and responsible risk management.

Allowed:

- Manual trading

- Algorithmic trading (EAs, bots)

- Scalping and swing trading

- News trading (with proper duration)

Not allowed:

- All-or-nothing trades (placing large, high-risk positions to hit target in one move)

- Spamming multiple orders in short bursts (order block spamming)

- Risking 3.5% to 5% or more on a single trade or tightly grouped trades

- Trade durations that consistently violate the 5-minute average rule

If your strategy relies on fast entries and exits, make sure your average trade duration across all positions is over 5 minutes, and that at least 50% of your profit comes from trades lasting longer than 5 minutes.

What trading instruments can I trade?

FundedFX gives you access to a wide range of tradable assets through Match Trader. You can trade:

- Forex pairs (majors, minors, exotics)

- Indices (such as NASDAQ, S&P 500, DAX, FTSE, etc.)

- Commodities (including gold, silver, oil, and natural gas)

- Stocks (selected US and international equities)

- Cryptocurrencies (like Bitcoin, Ethereum, and other majors)

The full list of available instruments may vary based on market conditions and platform updates. All assets come with clearly defined leverage levels and variable spreads.

Make sure to check your Match Trader platform for the complete list of supported assets and their trading conditions.

Do I need to use a stop loss on every trade?

Trading without a stop-loss is therefore your choice. If an open position breaches those limits, the account fails even if no stop-loss was set. Most traders use protective stops for sound risk management, but FundedFX leaves that decision up to you.

Can I pass the challenge early if I meet the profit target?

Yes. As soon as you have done both of the following, that phase is marked complete and you can move on without waiting for the full time period:

| Challenge | Requirement 1 : Profit target | Requirement 2 : Minimum trading days |

|---|---|---|

| 1-Step (single phase) | 8 % | 7 trading days |

| 2-Step – Phase 1 | 8 % | 5 trading days |

| 2-Step – Phase 2 | 5 % | 7 trading days |

After these two conditions are met, you can immediately transition to the next phase or receive your funded account, depending on where you are in the process. Our policy rewards consistent performance and avoids unnecessary waiting.

How is the 30% best day rule applied?

The 30% best day rule applies only to the on-demand payout option once you’re funded.

Here’s how it works:

- No single trading day should account for more than 30% of your total profit on the account.

- This rule is in place to prevent payouts being requested after just one lucky day or a single high-risk trade.

To request an on-demand payout, you must:

- Meet the 30% best day rule

- Have at least 2% of your gross profits remaining in the account after the payout is processed

If your best day does exceed 30%, you’ll need to trade more and balance out your performance before requesting an on-demand payout. The rule does not affect biweekly payouts.

Do I have to close all trades before the challenge ends?

Yes. All trades must be closed before your challenge period ends, whether you’re in Phase 1 or Phase 2.

If your challenge ends with open positions, those trades will not be counted, and the account may be considered incomplete or invalid—especially if they affect your final profit or loss calculation.

To avoid any issues, make sure all positions are closed before the final day ends, even if you’ve already met your profit target and minimum trading days.

Add-Ons

How can I increase my profit split?

Use a Profit Plus add-on.

Profit Plus 5: Pay 25% extra fee, boost payout from 80% to 85% (new split 85:15).

Profit Plus 10: Pay 30% extra fee, boost payout from 80% to 90% (new split 90:10).

Can I increase my daily loss limit in the challenge?

Yes, with FlexiShield or BufferZone add-ons.

2-Step Challenges:

FlexiShield: +2% (5% → 7%) for 25% fee.

BufferZone: +3% (5% → 8%) for 30% fee.

1-Step Challenges:

FlexiShield: +2% (4% → 6%) for 25% fee.

BufferZone: +3% (4% → 7%) for 30% fee.

Can I raise my overall max loss?

Yes, with DeepGuard.

2-Step Challenges: +2% to both daily (5% → 7%) and max loss (10% → 12%) for 35% fee.

1-Step Challenges: Max loss 8% → 10% for 35% fee.

Can I finish my challenge faster by reducing minimum trading days?

Yes, with FastTrack or Express Entry.

2-Step Challenges:

FastTrack: -2 days (Phase 1: 5 → 3, Phase 2: 7 → 5) for 25% fee.

Express Entry: -3 days (Phase 1: 5 → 2, Phase 2: 7 → 4) for 30% fee.

1-Step Challenges:

FastTrack: 7 → 5 days for 25% fee.

Express Entry: 7 → 4 days for 30% fee.

Funded Account

What happens after I pass the challenge?

Once you finish every required phase and stay within the rules, FundedFX offers you a funded account that is the same size as the account you used during your evaluation.

What happens next:

- Account activation – You receive login details for your funded Match-Trader account.

- Agreement – You review and accept the funded-account terms.

- Live trading – After activation, you can trade with real capital and earn payouts according to your profit-split percentage.

If you continue to respect all risk-management limits, your account also becomes eligible for:

- Scaling increases (larger balance in set milestones)

- On-demand payouts

- Standard bi-weekly withdrawals

Maintain discipline and you can keep progressing and withdrawing profits without interruption.

How is the funded account different from the challenge account?

| Feature | Challenge Account (1-Step) | Challenge Account (2-Step) | Funded Account |

|---|---|---|---|

| Environment | Demo balance (prop model) | Demo balance (prop model) | Payouts from real capital May switch to true live execution after strong performance |

| Phase structure | Single phase | Phase 1 and Phase 2 | No phases |

| Time limit | 30 calendar days | 30 days (Phase 1) 60 days (Phase 2) | No time limit |

| Profit target | 8 % | 8 % (Phase 1) 5 % (Phase 2) | None |

| Draw-down rules (daily / overall) | 4 % / 8 % | 5 % / 10 % | Same limits carry forward |

| Payouts during the phase | None | None | Real payouts at 80 : 20 (up to 90 : 10 with add-ons) |

| Minimum trading days | 7 days | 5 days (Phase 1) 7 days (Phase 2) | None |

| Extras | Not applicable | Not applicable | Scaling increases, on-demand payouts, bi-weekly withdrawals |

The funded account removes the time clock, pays real profits, and lets you grow through the scaling plan—provided you keep respecting the draw-down limits.

How do payouts work?

Traders can choose between biweekly payouts or on-demand payouts, depending on their preference and eligibility.

Biweekly Payouts:

- Available to all funded traders

- Processed every 14 days

- Minimum gross profit required: $100

On-Demand Payouts:

- Can be requested anytime after meeting the following conditions:

- You meet the 30% best day rule (no single day made up more than 30% of total profits)

- At least 2% of your total profits remain in the account after the payout is withdrawn

- You meet the 30% best day rule (no single day made up more than 30% of total profits)

- Processed quickly once conditions are verified

Once you’re funded, payout requests can be made through your dashboard. Payments are sent to your chosen withdrawal method.

What is the minimum withdrawal amount?

The minimum amount you can withdraw is $100 in gross profit. This applies to both biweekly and on-demand payouts.

Gross profit means your total earnings before any splits or fees are applied. As long as your account has reached at least $100 in profit, you’re eligible to request a payout—provided you meet all other conditions (like the best day rule if you’re using on-demand).

How does the on-demand payout model work?

The on-demand payout model lets you request a withdrawal anytime after meeting two conditions:

- The 30% best day rule is satisfied

Your most profitable trading day must not account for more than 30% of your total profit. - You leave at least 2% of profits in the account

After your withdrawal, your account must still retain 2% of the total profit you’ve made.

If both conditions are met, you can submit a payout request directly from your dashboard. It will be reviewed and processed quickly. This gives you more flexibility compared to the standard 14-day payout cycle.

What is the 30% best day rule?

This rule ensures your payout is based on consistent performance, not one lucky day.

It works like this:

- After you make a profit on your funded account, your highest single-day gain must not be more than 30% of your total profits.

- If one day does exceed that 30% threshold, you won’t be eligible for an on-demand payout until you balance your profit distribution across more days.

This rule only affects on-demand payouts. You can still receive your biweekly payout even if your best day exceeded the 30% limit.

Do I need to maintain a profit buffer?

Yes. Once your funded account hits a 10% profit milestone, the system resets your max drawdown to your starting balance.

From that point on, you’re expected to maintain a buffer—which means not withdrawing all your profits at once.

If you withdraw your full profit after reaching the 10% milestone and leave nothing in the account, your funded account may be closed.

Keeping a portion of your profits in the account ensures you’re staying within drawdown rules and gives you room to continue trading safely.

What happens if I withdraw all profits?

If you withdraw 100% of your profits and leave no buffer in the account, your funded account will be closed.

Why? Because after reaching 10% profit, your drawdown is reset to your initial account balance. If there’s no profit buffer left and your balance drops below that reset level due to normal trading fluctuations, it’s an automatic breach.

To keep your funded account active, always leave at least a small percentage of profit in the account after a withdrawal.

How does scaling work?

FundedFX offers a scaling plan that allows traders to grow their capital based on consistent performance.

Each account size comes with a scaling ceiling, and as you continue trading profitably while respecting the rules, your account can be increased to a higher funding level.

For example:

- A $10K account can scale up to $40K

- A $200K account can scale up to $1M

Scaling is typically reviewed based on:

- Profitability over time

- Risk management (low drawdowns)

- Account stability and discipline

You don’t need to apply for scaling manually. If you qualify, the team will notify you, and your account will be upgraded accordingly.

How often can I request payouts?

You have two options for payout frequency:

- Biweekly payouts:

- Available to all funded traders

- Payouts processed every 14 days

- Minimum required profit: $100

- Available to all funded traders

- On-demand payouts:

- Can be requested anytime

- Must meet the 30% best day rule and retain 2% profit in the account after withdrawal

- Can be requested anytime

There’s no limit to the number of payout requests—as long as you meet the eligibility rules for the option you’re using.

Are news trades allowed in funded accounts?

Yes, news trading is allowed. However, there’s a timing rule you must follow:

- If you open or close a trade within 2 minutes before or after a major news event, that trade must remain open for at least 2 minutes.

This rule helps ensure that trades placed around high-impact events are not purely exploitative. As long as your news trades follow this rule, they are fully permitted.

Algorithmic & Trading Rules

Can I use a trading bot or Expert Advisor (EA)?

Yes. FundedFX allows automated trading systems as long as they follow all rules — no latency abuse, no high-frequency (sub-second) activity, and all trades must stay open for at least 2 minutes.

What is the 2-minute rule?

Every trade must remain open for at least two minutes (120 seconds) before you close it manually. If most of your trades close faster than that, our system will flag your account for review.

What is the 5-minute rule and how does it work?

The 5-minute rule is part of FundedFX’s evaluation filter. It means:

- Your average trade duration must be more than 5 minutes.

- At least half of your total profit (50%) must come from trades that lasted longer than 5 minutes.

It’s meant to ensure that traders show real market exposure, not just short-term scalping. It applies automatically to all challenge and funded phases.

Aren't the 2-minute and 5-minute rules conflicting?

No. They serve different purposes:

- The 2-minute rule stops unfair ultra-short trades (technical filter).

- The 5-minute rule ensures your overall trading behavior shows meaningful exposure (performance filter).

So you can occasionally close trades after 2 minutes, but overall you should average over 5 minutes and earn most profits from longer trades.

Are there exceptions to the 2-minute rule?

Yes. If a trade closes automatically because it hits your Stop-Loss (SL), Take-Profit (TP), or margin stop-out, it won’t count as a violation.

Can I trade during news events?

Yes, but you can’t open new trades within two minutes before or after major news releases (like NFP or FOMC). You can manage existing trades.

Can I hold trades over the weekend?

No, unless FundedFX specifically allows it for your account type. All trades must be closed before Friday market close.

What happens if I break these rules?

We may exclude the trades, deny payouts, suspend or terminate your account, or remove you from the program — depending on the severity.

Can I appeal a decision or investigation?

Yes. You can send your EA logs, trade data, and an explanation to support@fundedfx.com within 5 business days. Our compliance team will review and issue a final decision.

Why does FundedFX use these rules?

These rules ensure fair competition, real trading skill assessment, and protect both traders and FundedFX from algorithmic abuse or market manipulation.

Affiliate

Does FundedFX have an affiliate program?

Yes. FundedFX has a structured affiliate program that allows anyone to earn commissions by referring new traders. Whether you’re a trader, content creator, educator, or community manager, you’re welcome to join and start promoting right away.

Anyone can start referring and earning—no prior trading experience required.

How does the affiliate commission structure work, and what are the tiers?

The affiliate program runs on a tiered structure. The more referrals you bring, the higher your commission percentage becomes.

Here’s how the tiers are set up:

Tier | Number of Referrals | Commission |

Tier 1 | Fewer than 100 referrals | 10% per sale |

Tier 2 | 100+ referrals | 12% per sale |

Tier 3 | 250+ referrals | 15% per sale |

Your tier is based on the total number of successful referrals, and you can move up as your numbers grow.

How and when are commissions paid out?

Commission payouts depend on your tier:

- Tier 1 and Tier 2: Paid out monthly

- Tier 3: Paid out biweekly (every two weeks)

Commissions are typically paid through your selected payment method, and you can track all pending and completed payouts in your affiliate dashboard.

Do my referrals get a discount?

Yes. Every referral that signs up through your link will automatically receive a discount on their challenge fee, based on your tier:

Tier | Referral Discount |

Tier 1 | 5% |

Tier 2 | 5% |

Tier 3 | 7.5% |

This discount gives your audience an incentive to sign up through your link, and it helps boost your conversions.

Where can I get my referral link and track performance?

Once you join as an affiliate, you’ll get full access to the Affiliate Dashboard, where you can:

- See your referral link

- Track conversions

- View your commissions and payouts

Everything is accessible instantly through your dashboard, no need to email support to check your numbers.

Can I promote FundedFX on social media, ads, or SEO?

Yes, you’re free to promote FundedFX through most online channels, including:

- Social media platforms like Instagram, Twitter, YouTube, TikTok, and Facebook

- Blogs, websites, and SEO-optimized content

- Paid ads, as long as they follow FundedFX’s promotion guidelines

That said, spamming, misleading advertising, or impersonating the FundedFX brand is strictly not allowed. If you plan to run paid ads, make sure you’re not violating the platform’s ad policies or the firm’s terms of promotion.

Always keep it honest, ethical, and aligned with the FundedFX brand.

Is there a limit to how many people I can refer?

No. There is no cap on how many people you can refer. You can refer as many traders as you want and continue earning commissions as long as your referrals remain active and purchase accounts.

In fact, the more referrals you bring in, the faster you move up the affiliate tiers—and the more you earn per sale.

Can I become an affiliate if I’m already a funded trader?

Yes. Funded traders are welcome to join the affiliate program. In fact, many affiliates are funded traders who share their experience and success with others.

You can promote the program, earn commissions on referrals, and still keep trading your funded account with no conflict. It’s a great way to add an extra income stream while staying focused on your trading.

How do I apply to become an affiliate?

Applying is quick and simple. Create an account or login to the dashboard.

Join the Affiliate Program: After logging in, click on “Prop” in the top menu, navigate to the Affiliate section, and join the program directly from your dashboard.

Promote Your Unique Link: Share your referral link on social media, websites, or communities to start attracting sign-ups.

Earn Commission and Track Progress: Earn commissions when referrals register and make purchases through your link.

You can monitor your clicks, sign-ups, and payouts in real time through your affiliate dashboard.

Match Trader Platform

How to use the Match Trader Platform?

Match-Trader Trading Platform

On the trading platform, you have access to all the essential information regarding your trading account.

(1) Trading Account Number– Trading Account Number By clicking on the account number, you will get an overview of all trading accounts associated with this email address. Additionally, you have the option to open a new trading account.

- (2) Balance – balance of trading account

- (3) Equity – equity of trading account

- (4) Free Funds – free funds of the trading account

- (5) Margin – margin of the trading account

- (6) Margin level – margin level of the trading account

- (7) Profit – Profit on open transactions

(8) Deposit Button- A button that allows you to make a deposit into your account.

Next to the Deposit Button, you’ll find another button. Clicking on it will reveal additional tabs.

(9) Deposit – Button allowing you to make a deposit

(10) Withdraw – Button allowing you to make a withdrawal

(11) Inbox – Tab where all incoming messages are stored

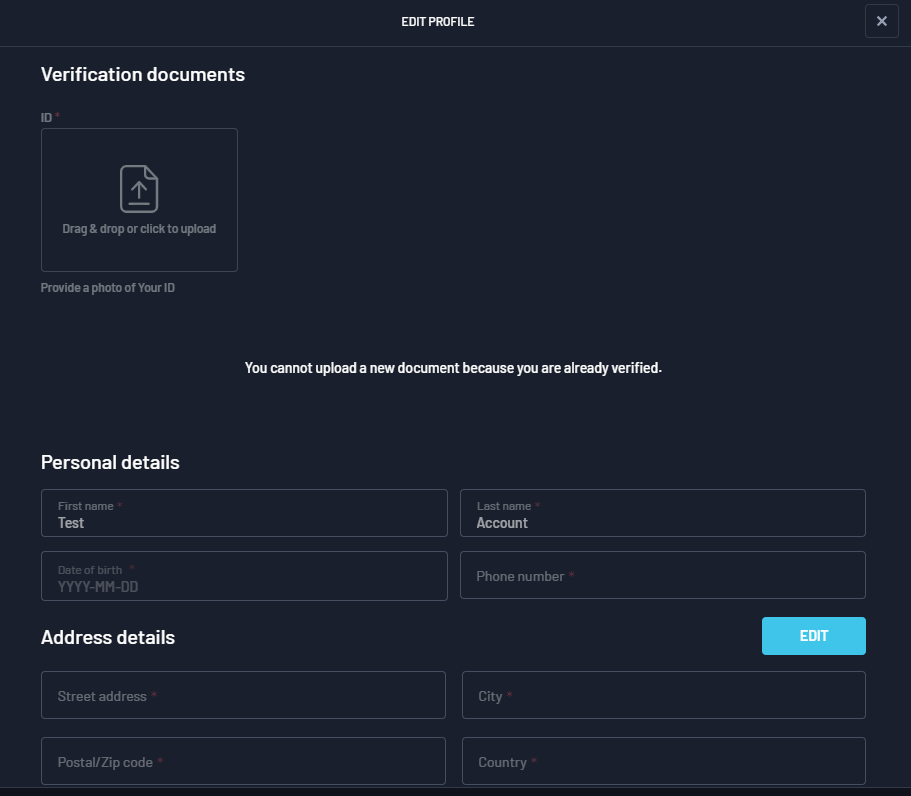

(12) Edit Profile – Tab allowing you to edit account information

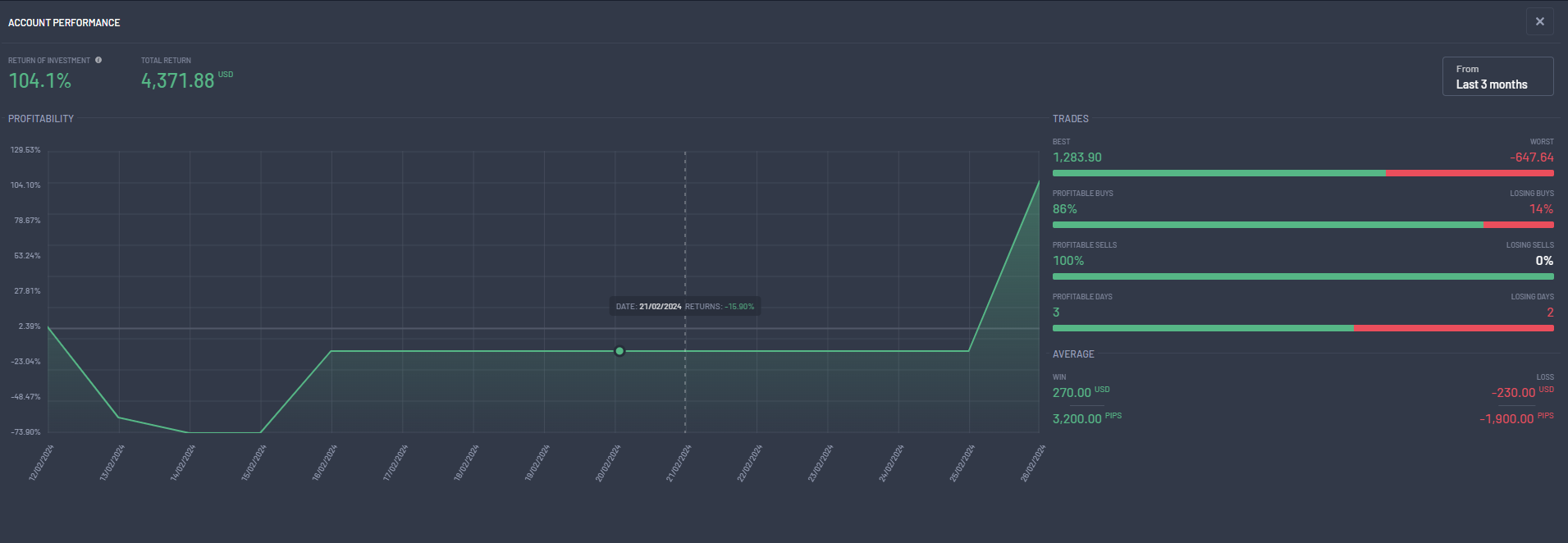

(13) Trade Performance – Tab where you can check your trade performance

(14) Add Account – Tab through which you can request a new trading account

(15) Become IB – Allows you to submit a request for the account to become an Introducing Broker

(16) Become Money Manager – Allows you to submit a request for the trading account to become a Money Manager (when Social Trading is configured)

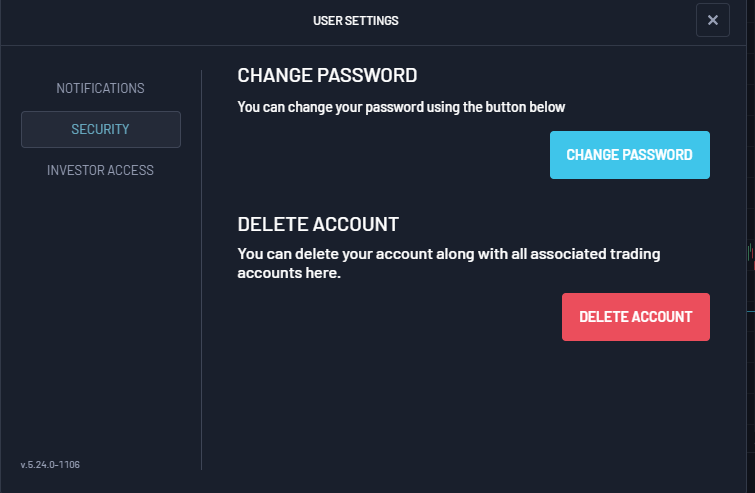

(17) User Settings – Tab where you can manage account settings;

- Notifications – Manage notifications

- Security – Tab enabling password change or account deletion

- Investor Access – Tab allowing you to generate investor access, providing view-only permission

(18) Restart – Button allowing platform restart

(19) Install Desktop App – Tab where clicking will display a video on how to download the desktop application

(20 )About Us – Contains information about the company

(21) Contact – Tab containing information for contacting the broker

(22 )Language – Allows you to change the language

(23 )Dark Mode/Light Mode – Allows you to set the platform mode

(24 )Log Out Button – Button to log out

There is a chart in the central part of the platform. Above it, there are tabs that allow you to configure the chart to your preferences

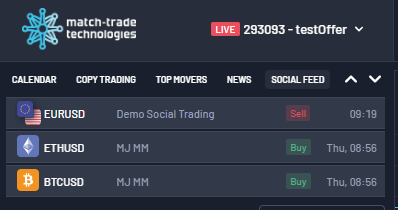

On the left side of the platform, you’ll find a window that adjusts based on the selected tab

- Calendar– Displays key market information.

- Copy Trading– Allows clients to manage copy trading.

- Top Movers– Shows instruments with the highest daily volatility.

- News– Contains the latest news updates.

- Social Feed- Displays recent activities in social trading

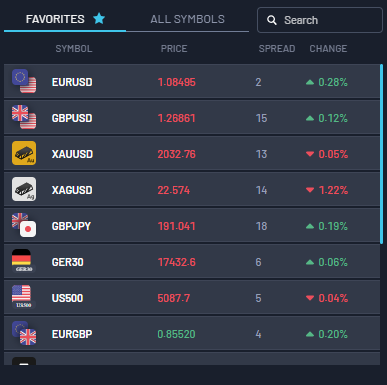

Symbol table- In this section, you have an overview of the instruments available on the platform

Favorites– Here, you can add your favorite instruments for quick access.

All Symbols– This tab displays all available symbols on the platform

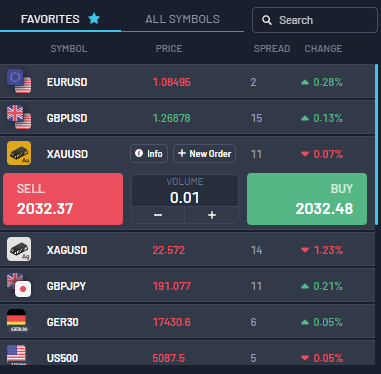

When you click on the instrument, some information will be displayed

- Buy/Sell Button– Buttons allow you to instantly enter a position at the current price.

- Volume– Adjusts the position size.

- New Order– Tab allowing you to open a new position

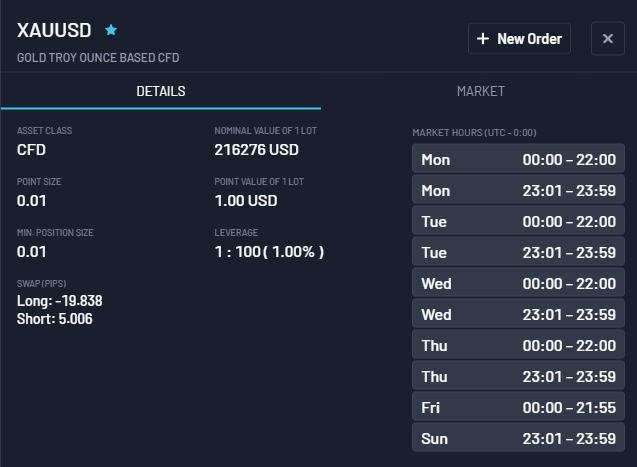

Info– Provides key information about the instrument

Information is displayed in the details tab

- Asset Class

- Nominal Value of 1 Lot

- Point Size

- Point Value of 1 Lot

- Min Position Size

- Leverage

- Swap

- Market Hours

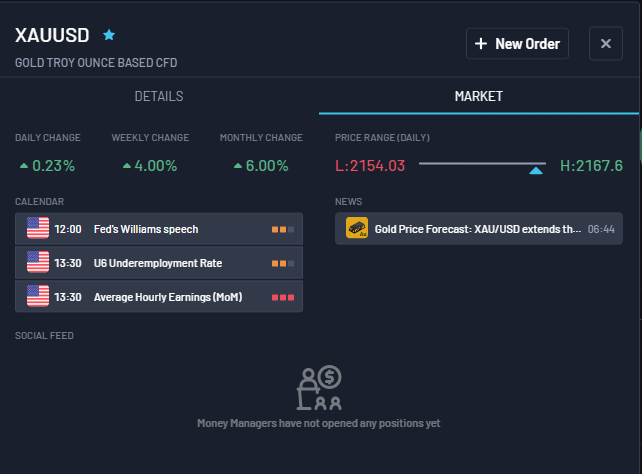

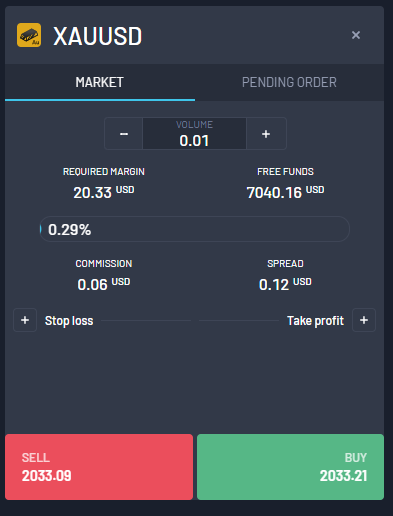

Market – a tab providing important market information about the symbol

New Order– Tab allowing you to open a new position

- Market– Tab for placing an order at the market price.

- Required Margin– The amount required to open a position.

- Free Funds– Available funds.

- Stop Loss– Button for setting a Stop Loss.

- Take Profit– Button for setting a Take Profit.

- Commission– Commission value for opening a position.

- Spread– The difference between BID/ASK prices.

- Stop loss – stop loss price set to the position

- Take profit – take profit price set to the position

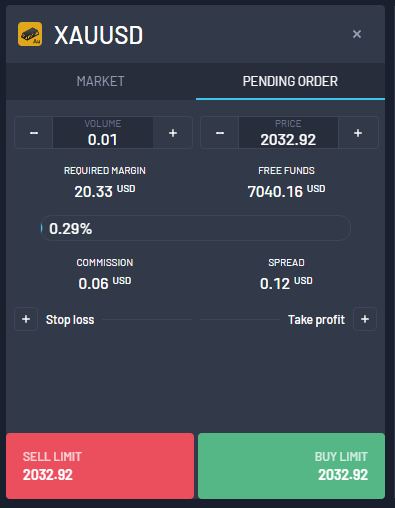

Pending Orders- This tab allows you to place pending orders

- Required Margin– The amount required to open a position.

- Free Funds– Available funds.

- Stop Loss- Button for setting a Stop Loss.

- Take Profit– Button for setting a Take Profit.

- Commission– Commission value for opening the position.

- Spread– The difference between BID/ASK prices.

- Stop Loss– Stop loss price set for the position.

- Take Profit– Take profit price set for the position.

Once you have set your Stop Loss/Take Profit, you can edit the Stop Loss/Take Profit value directly on the chart with the drag-and-drop option

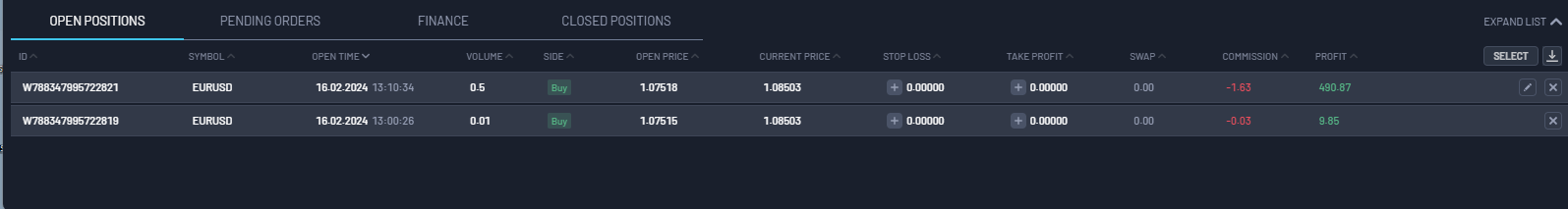

Open Positions- Displays information about open positions

- Order ID– ID of the position.

- Symbol– Instrument on which the position has been opened.

- Open Time– open time of the position

- Volume– – volume of the opened position. By default it’s showed in lots

- Side– market side of the position

- Open Price– – open price of the position

- Current Price– – market price of the instrument

- Stop Loss– Stop loss price set for the position.

- Take Profit– Take profit price set for the position.

- Swap– Swap value of holding the position.

- Commission– The commission paid for opening the position

- Profit– Profit after swaps and commissions.

- Select– Button enabling selection and closure of multiple positions at once.

- Close Position– Button enabling closure of a position

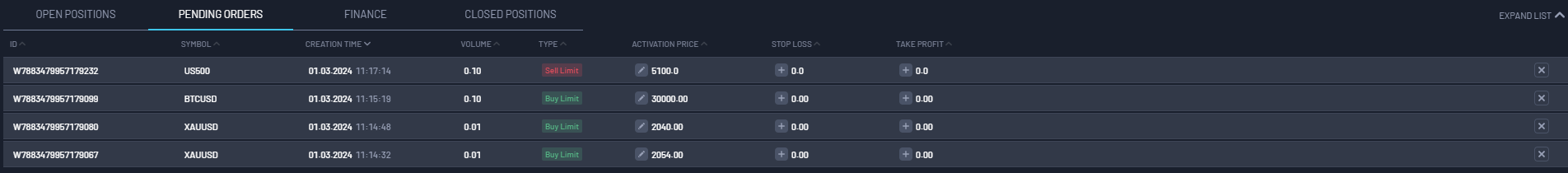

Pending Orders- This tab displays information about pending orders.

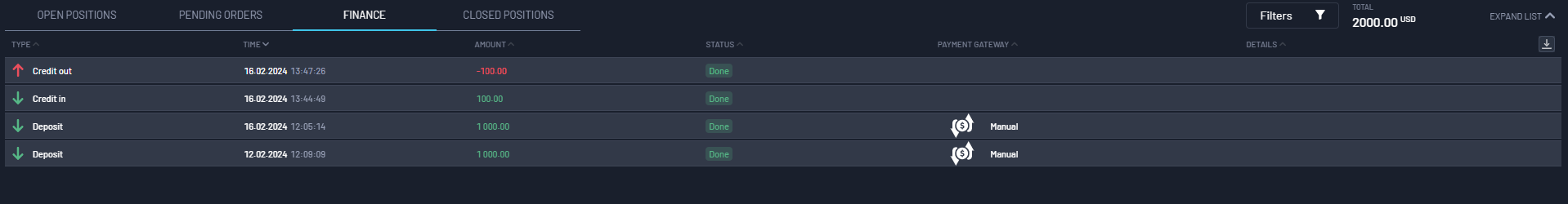

Finance- This tab displays information about all financial operations conducted on the account.

Close Position Tab- This tab displays all information about closed positions.

- Reason– Reason for closing the position.

- Share Trade– Allows the sharing of trades.